indiana excise tax alcohol

Indiana Alcoholic Beverage Permit Numbers List the Indiana Alcoholic Beverage Permit Numbers obtained from the Indiana Alcohol and Tobacco Commission. Cigarettes - 043 per pack.

President Signs 2 3 Trillion Bill Making Federal Excise Tax Fet Reduction Permanent For Distilleries Step 3 Of 3 Distillery Trail

The Indiana State Excise Police is the law enforcement division of the Alcohol Tobacco Commission.

. State Excise police officers are empowered by statute to enforce the laws and. From July 1 2021 to June 30 2022 the Special Fuel tax rate is 053 per gallon rate the combined state and federal rate is 07740 Type II Gaming Tax. Alcoholic Beverage Wholesalers Excise Tax Return.

Indianas general sales tax of 7 also applies to the. Excise Tax Calculation BEER Tax rate 0115 CIDER Tax rate 0115 LIQUOR Tax rate 268 WINE Tax rate 047 1. Apply for employment as an Indiana State Excise Police officer.

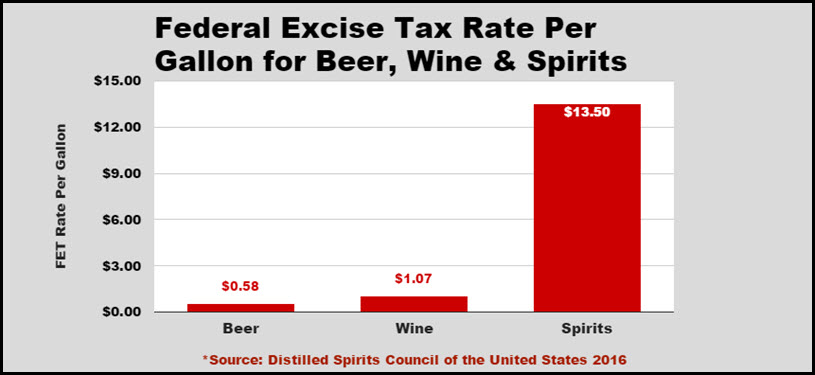

Gallons Received During Reporting Month from. 3 rows Indiana Liquor Tax - 268 gallon. House Bill 1604 would raise the excise tax on liquor beer and wine sales by 100.

An excise tax is a tax imposed on a specific good or activity. Indiana Alcoholic Beverage Permit Numbers Section B. The price of all motor fuel sold in Indiana also includes Federal motor fuel excise taxes which are collected from the manufacturer by the IRS and are used to.

Although electronic filing is required paper forms with instructions are available so customers can visualize what is required. Physical AddressCityStateZIP Indiana Tax Identification Number Mailing AddressCityStateZIP Telephone Number Business Web Address Indiana Alcoholic Beverage Permit Numbers. The Commission is currently reviewing the opinion to determine how if at all the decision will impact Indianas alcohol laws and permittees.

And for wine the pay an extra 47 cents. For beer they pay an extra 11 and one-half cents. Property Tax Clearance Schedule SF 1463 Effective August 21 2017 all Property Tax Clearance Schedules must be.

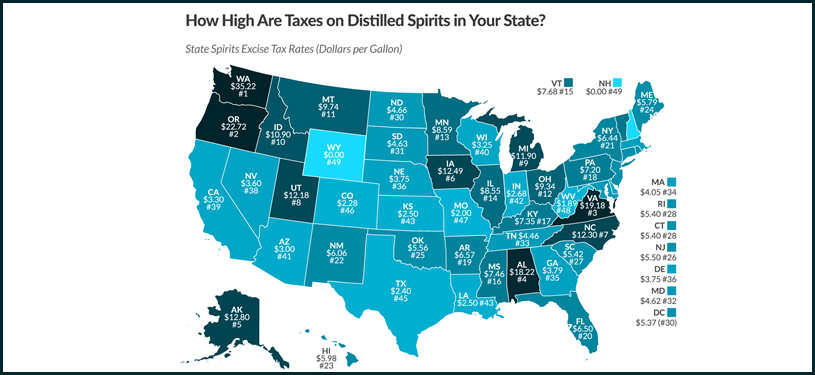

FEDERATION OF TAX ADMINISTRATORS -- JANUARY 2022 STATE TAX RATES ON DISTILLED SPIRITS January 1 2022 EXCISE GENERAL TAX RATES SALES TAX STATE per gallon. Excise taxes are commonly levied on cigarettes alcoholic beverages soda gasoline insurance premiums. Gasoline Cigarette and Alcohol Excise Tax Rates By State.

The paper forms with instructions shown below are available so customers can visualize what is required. Attend a certified server training program in my area. Liquor - 1822 per gallon.

Excise Tax Calculation BEER Tax rate 0115 CIDER Tax rate 0115 LIQUOR Tax rate 268 WINE Tax rate 047 1. Have a State Excise Officer speak at my school or organization. Purchasers of spirits in Indiana have to pay a state excise tax of 268 per gallon.

NOTICE - The Indiana Alcohol. This 42 million tax hike alone would cause the price of distilled spirits to rise by 7 and would. Federal Fuel Excise Taxes.

All forms must be filed electronically. Indiana Alcohol Tobacco Commission. Excise Police Indiana State 10 Articles Follow New articles New articles and comments Do I need any type of permit to dispense alcoholic beverages at my one time event.

Gas - 1600 per gal. Indiana State Excise Police. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax.

10 of total sales.

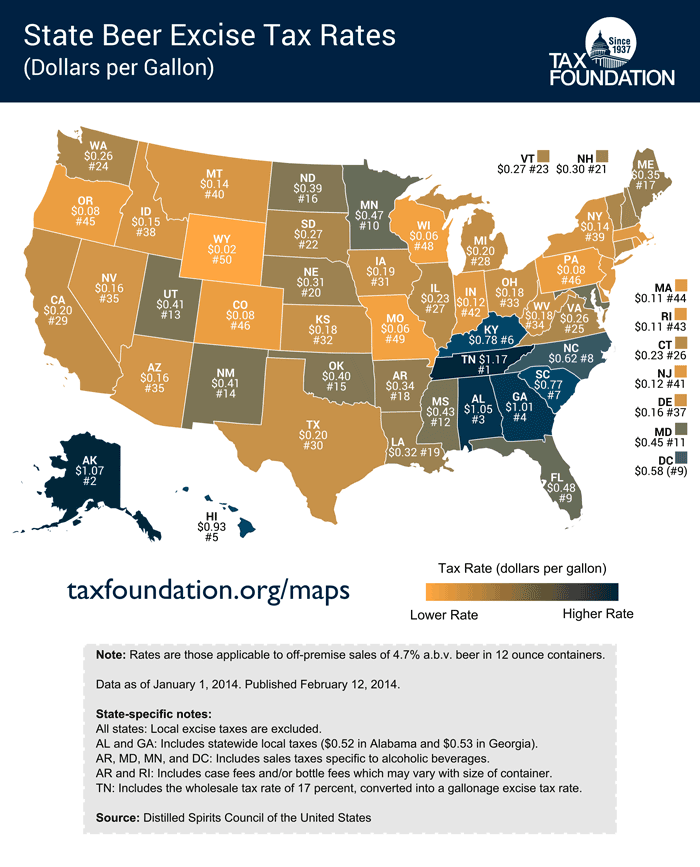

State Alcohol Excise Tax Rates Tax Policy Center

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Form Excises2 Download Printable Pdf Or Fill Online Excise Tax Bond Massachusetts Templateroller

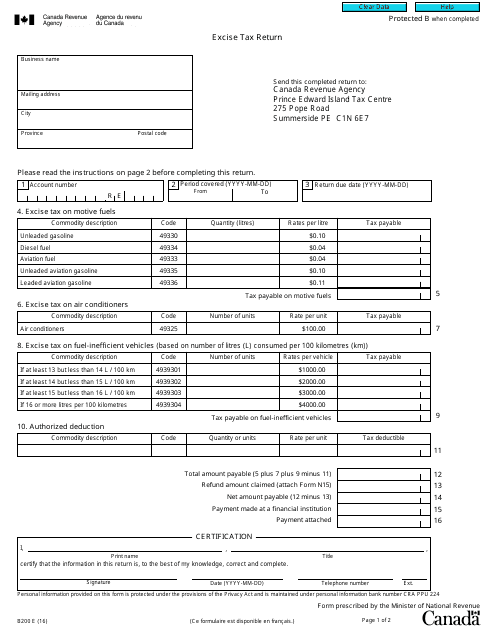

Form B200 Download Fillable Pdf Or Fill Online Excise Tax Return Canada Templateroller

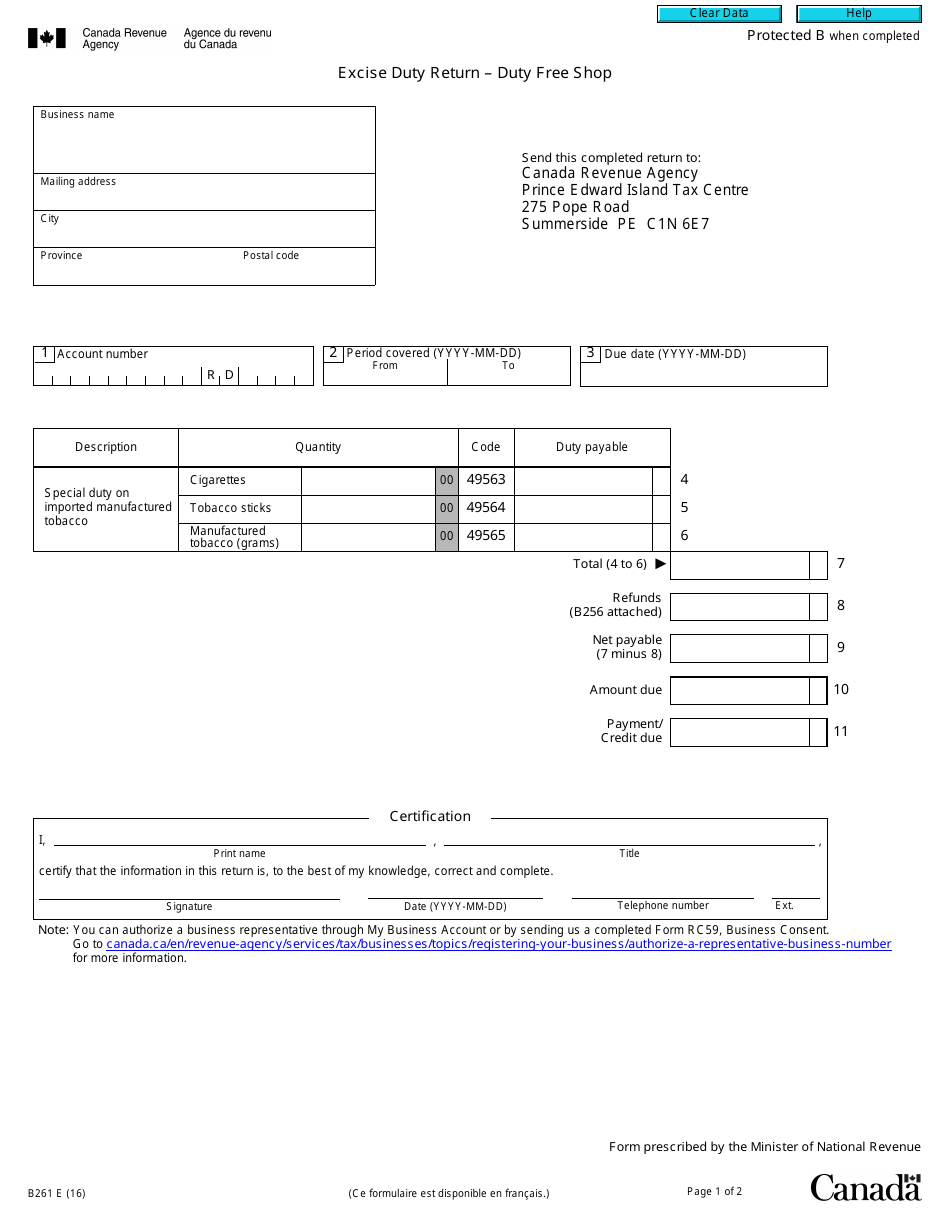

Form B261 Download Fillable Pdf Or Fill Online Excise Duty Return Duty Free Shop Canada Templateroller

Indiana Alcohol Taxes Liquor Wine And Beer Taxes For 2022

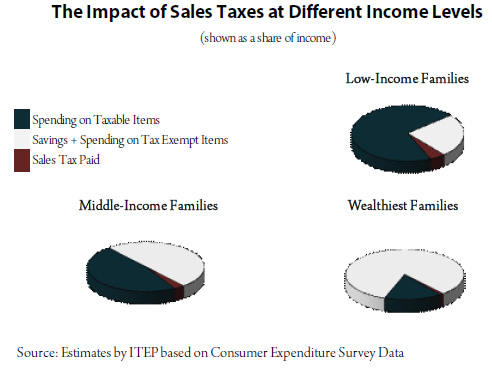

How Sales And Excise Taxes Work Itep

Excise Duty Cannot Be Levied By State On Alcohol Which Is Not Fit For Human Consumption Supreme Court

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

State Cigarette Excise Tax Rates United States April 2015 Download Scientific Diagram

Motor Fuel Taxes Urban Institute

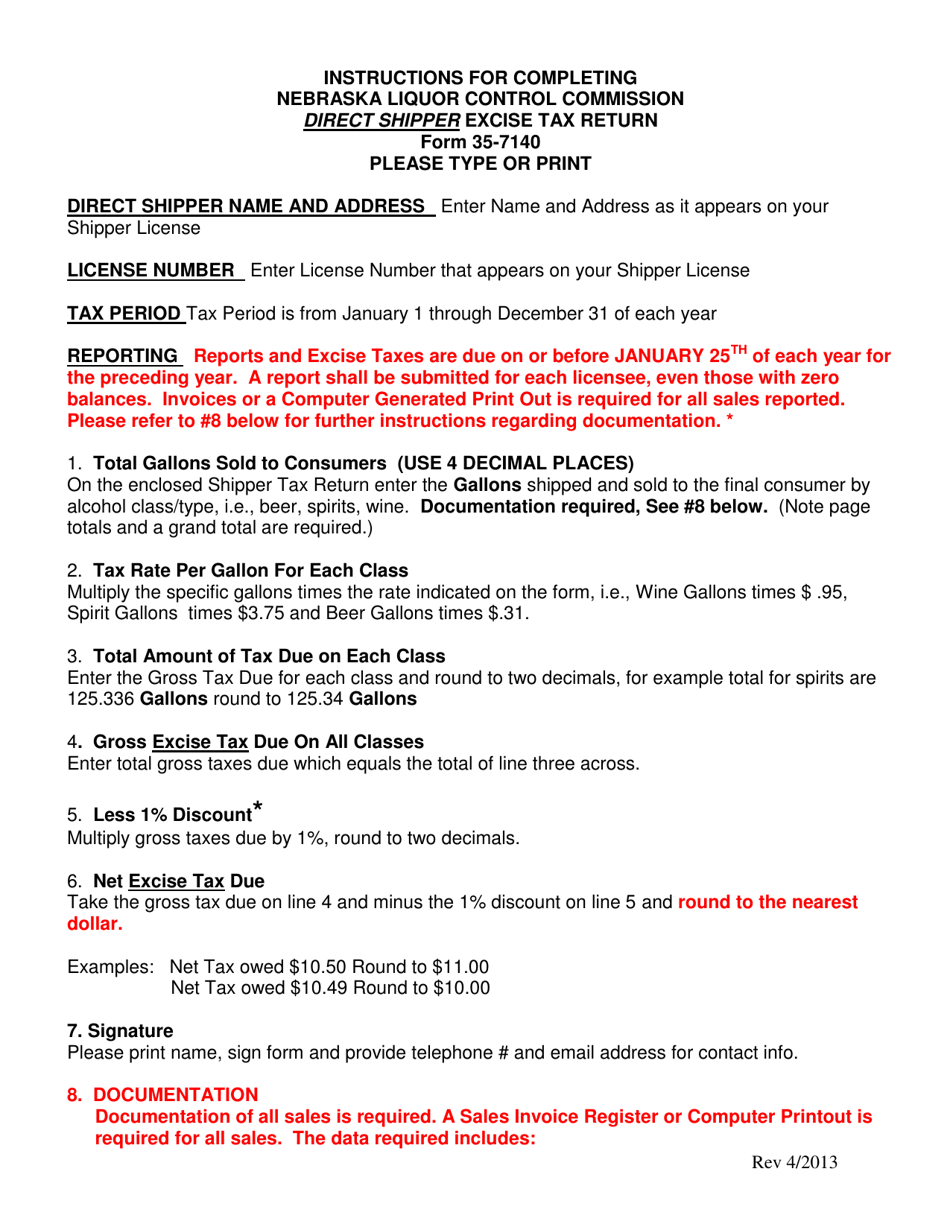

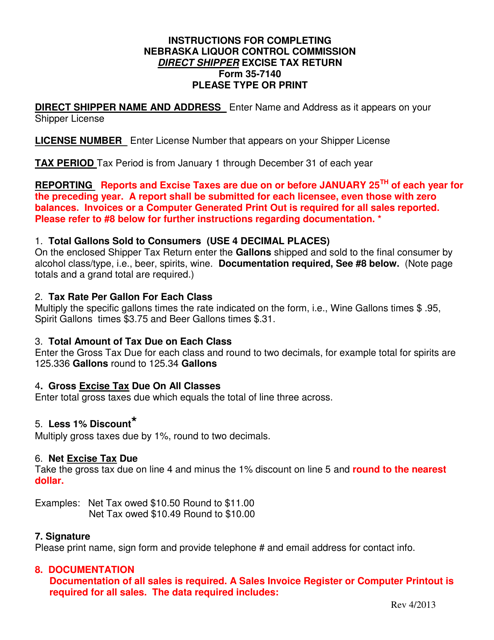

Download Instructions For Form 35 7140 Direct Shipper Excise Tax Return Beer Spirits And Wine Pdf Templateroller

These States Have The Highest And Lowest Alcohol Taxes

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Infographic Math Review Finance Investing

Download Instructions For Form 35 7140 Direct Shipper Excise Tax Return Beer Spirits And Wine Pdf Templateroller