how much taxes are taken out of paycheck in michigan

An additional 5 may be taken if youre more than 12 weeks in arrears. 33 Is it Possible to Owe Taxes in More Than One State.

Michigan Study Refutes Poor People Pay No Taxes Claim Public News Service

It went from a flat rate of 340 to 330 in 2015 and then.

. FUTA taxes are reported annually. Coronavirus Aid Relief and Economic Security CARES Act permits self-employed individuals making estimated tax payments. If you have paid in 6500 through withholding over the course of the tax year youll receive a 500 tax refund.

3 Michigan 12-2. Taxes can really put a dent in your paycheck. Customize using your filing status deductions exemptions and more.

Register with your employees state tax agency. Businesses must also report how much federal payroll tax they withheld and paid throughout the year. For FICA taxes this is typically done quarterly but in some instances where the total tax liability is small it may be done annually.

What Is The Deadline For Filing Taxes In 2021. The IRS will issue you a tax refund. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

Next time youre in line to get a raise figure out how much it will add to your paycheck and have it automatically deposited in a separate bank account or at another bank entirely. Generally the sooner you file your taxes the sooner youll see your refund in the bank and it reduces the chances of tax fraudThe amount that you receive if any depends on a number of factors including how much of your income isnt subject to tax withholding how many deductions and credits you claim and how you filled out your W-4 which is the form your. If your employee works from home in another state there are three things you need to do.

2 Why Do I Owe State Taxes. Coronavirus Tax Relief for Self-Employed Individuals Paying Estimated Taxes. In 2020 an executive memo was released allowing employers to defer payroll taxes for employees.

The penalty maxes out at 25 of the taxes you owe. What Is Form 8995 For Taxes. The federal government considers unemployment benefits to be taxable income although taxes are not automatically withheld from benefits payments the way an employer might take taxes out of your paycheck.

Therefore if you owed 210 in taxes and you waited 60. Taxes for remote employees out of your state. Look Out for Legal Changes.

Instead unemployment recipients must request that taxes be withheld from their benefits and the withholding is limited to 10. Finding the best car for you. Individual income taxes are a major source of state government revenue accounting for more than a third of state tax collections.

Find out how much youll pay in Indiana state income taxes given your annual income. On average about 10. However if you dont file within 60 days of the April due date the minimum penalty is 210 or 100 of your unpaid tax whichever is less.

If you arent supporting a spouse or child up to 60 of your earnings may be taken. This calculator is intended for use by US. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

32 Every State Has a Different Method of Calculating its Taxes. 31 The Main Differences Between State and Federal Taxes. Most car dealers arent really out to rip you off but keep in mind that car dealerships are for-profit entities.

If you receive a paycheck the Tax Withholding Estimator will help you make sure you have the right amount of tax withheld from your paycheck. These are contributions that you make before any taxes are withheld from your paycheck. 1 SoWhy Do I Owe State Taxes but Not Federal.

For example you might complete your tax return and then realize that your total tax liability is 6000. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. 21 Why We Have Pay State Income Tax.

But with a Savings or CD account you can let your money work for you. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. The credit begins to phase out for taxpayers with federal adjusted gross income FAGI above 200000 single filers or 400000 MFJ.

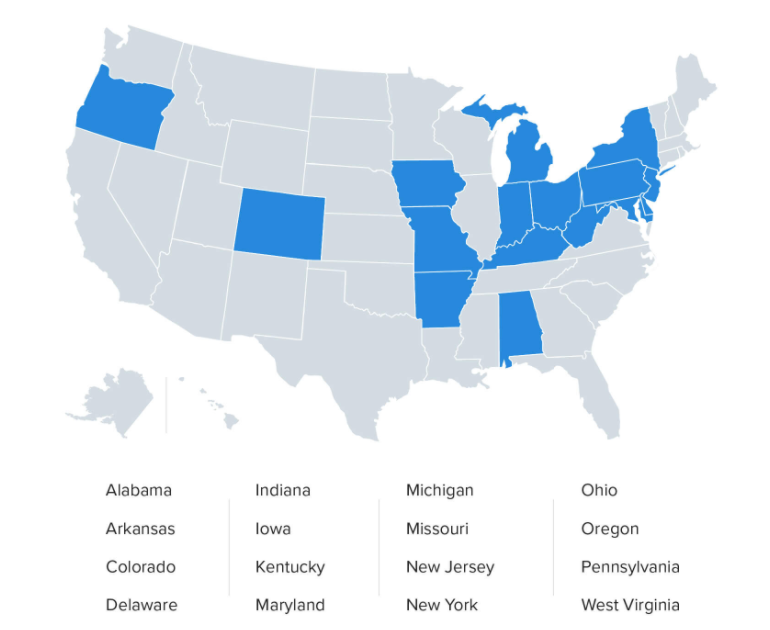

Right off the bat escrow gets taken out of every check. Internal Revenue Service PO. Indiana Michigan Kansas Montana Minnesota North Dakota Nebraska Oklahoma Ohio Wisconsin or South Dakota.

Since youll be withholding income taxes in your employees home state youll need to register with the state and possibly local tax agencies. Start by hiding any new income from your spouse. Box 802501 Cincinnati OH 45280.

How Much Money Is Taken Out Of Paycheck For Taxes. Additionally IRS Notice 2020-65 allows employers to defer. The same paycheck covers less goods services and bills.

It can also be used to help fill steps 3 and 4 of a W-4 form. Employers who chose to defer deposits of their share of Social Security tax were required to pay 50 of the eligible deferred amount by December 31 2021 and the remaining amount by December 31 2022. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax.

If you use direct deposit to receive your paycheck this step will be simple. In this article youll find details on wage garnishment laws in Michigan with citations to statutes so you can learn more. If you paid more tax than you owe either through withholding or estimated payments you have overpaid.

Wait until chris pronger finds out. 6 min read May 09 2022. State payroll tax deposit and filing procedures vary by state.

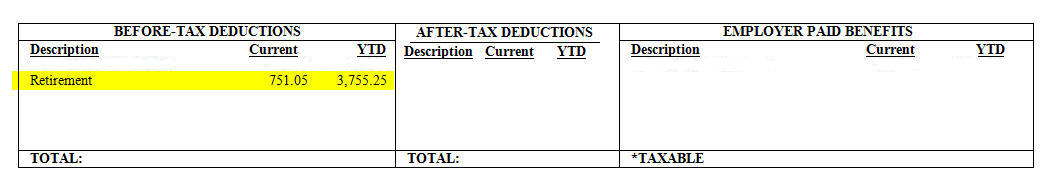

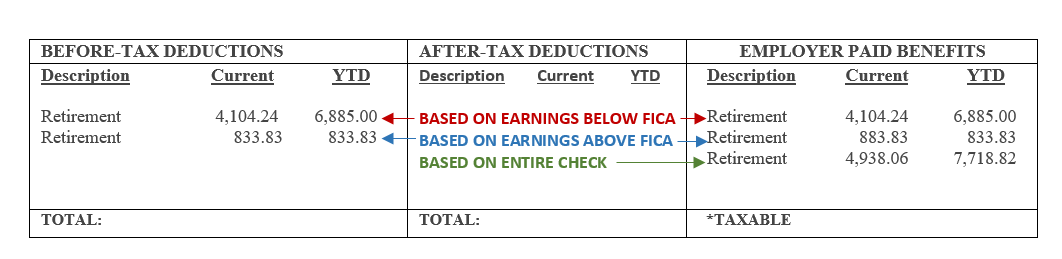

For The Federal And State Taxes The Retirement Is Chegg Com

Mi Mi W4 2020 2022 Fill Out Tax Template Online

Michigan Sales Tax Calculator Reverse Sales Dremployee

Average Taxes Taken Out Of Paycheck In Michigan Tax Walls

This Is The Ideal Salary You Need To Take Home 100k In Your State

Meter Maid Salary In Detroit Mi Comparably

Americans Should Be Prepared For A Smaller Tax Refund Next Year

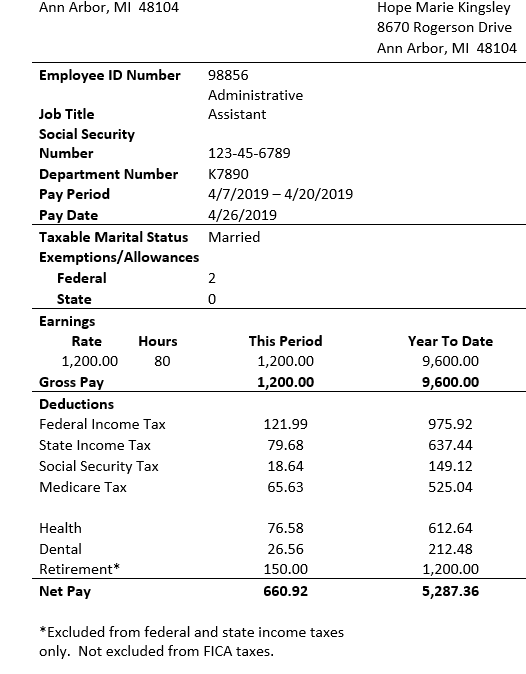

Understanding Your Paycheck Human Resources University Of Michigan

Understanding Your Pay Statement Office Of Human Resources

Understanding Your Paycheck Human Resources University Of Michigan

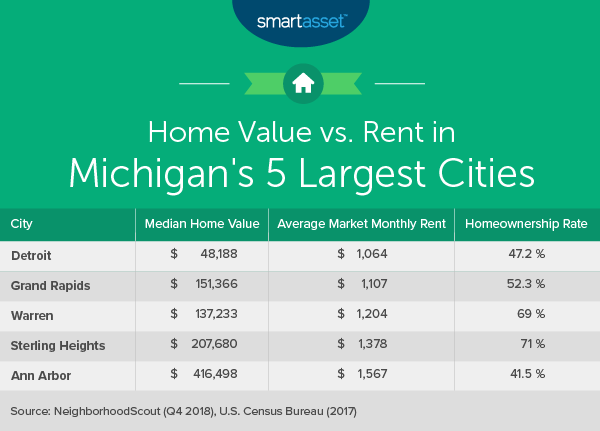

The Cost Of Living In Michigan Smartasset

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

Free Online Paycheck Calculator Calculate Take Home Pay 2022

2022 Federal State Payroll Tax Rates For Employers

I Worked From Home For A Significant Portion Of Th

Help Michigan W 4 Tax Information